Beyond finance is a reputable company that offers financial assistance and debt management solutions. They are known for their reliable services and dedication to improving individuals’ financial situations.

With a team of experts, beyond finance provides personalized guidance and support to help clients regain control of their finances and achieve their financial goals. By offering debt settlement, debt consolidation, and credit counseling, beyond finance assists individuals in reducing their debt burdens and improving their overall financial health.

Credit: www.listennotes.com

The Impact Of Technology On Wealth Management

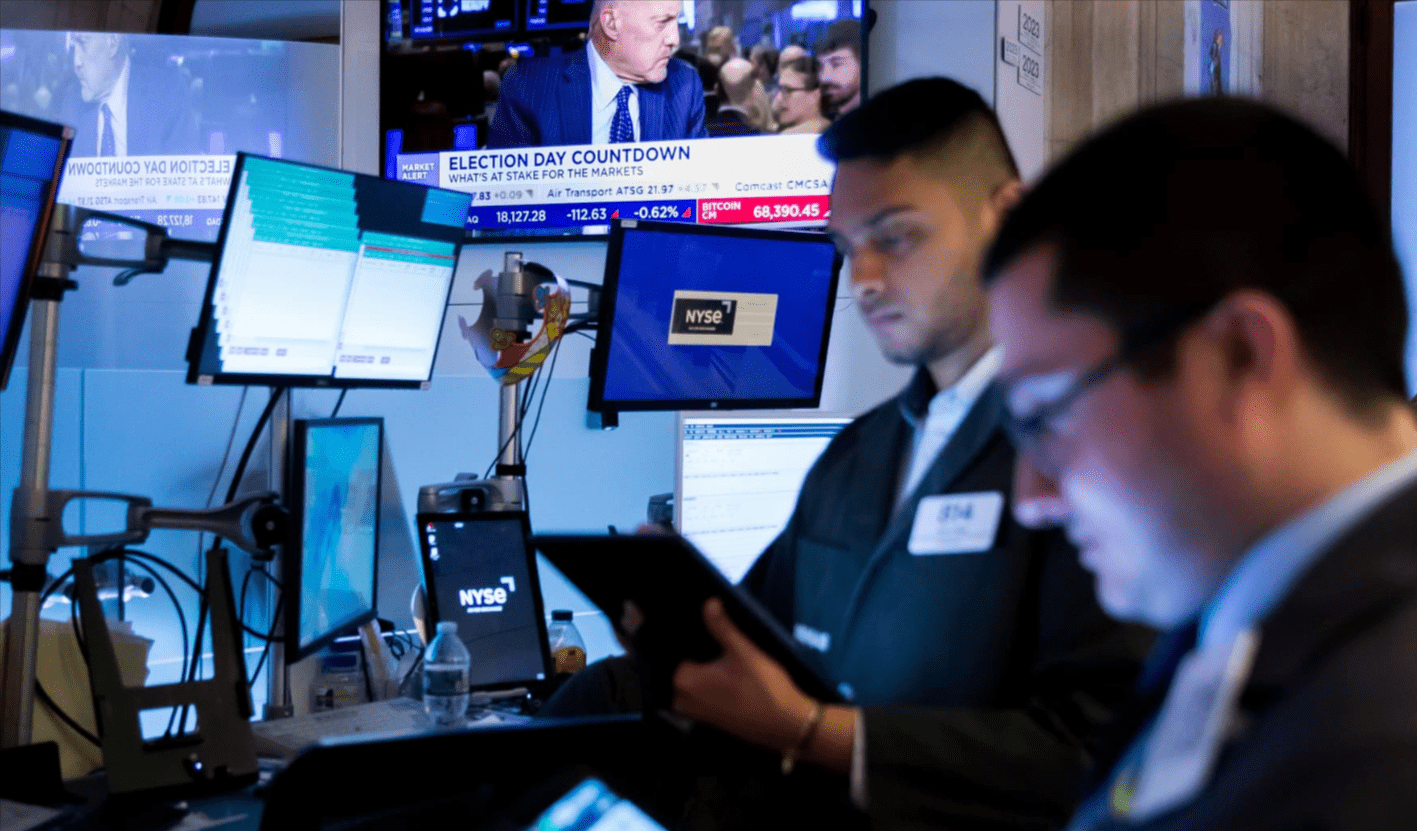

Wealth management is experiencing a significant impact from technology. Investment and asset management processes are being automated, thanks to advancements in technology. Robo-advisors have emerged, revolutionizing the wealth management industry. These digital platforms provide automated investment advice, tailored to individual preferences.

Artificial intelligence and machine learning play a vital role in financial planning, utilizing data to make informed decisions. With ai’s ability to analyze vast amounts of information, personalized investment strategies can be developed. Investors can benefit from the efficiency and accuracy offered by these automated systems.

The rise of technology brings new opportunities for wealth management and opens doors to a wider range of investors. The integration of technology in wealth management continues to shape the industry, providing innovative solutions for financial planning. Technology transforms the way wealth management functions, offering convenience, accessibility, and personalized advice to investors.

Diversifying Wealth Beyond Traditional Asset Classes

Diversifying your wealth goes beyond traditional asset classes and exploring alternative investments is key. One option to consider is investing in real estate, which offers numerous benefits and considerations. Real estate can provide a steady stream of income through rental properties, while also benefiting from appreciation over time.

However, it requires careful research and understanding of the market. Another avenue worth exploring is cryptocurrencies, which have the potential for significant wealth accumulation. Cryptocurrencies offer high volatility and the opportunity for substantial returns, but also come with risks and the need for thorough understanding.

By diversifying your portfolio with alternative investments like real estate and cryptocurrencies, you can potentially enhance your overall wealth accumulation strategy. Understanding the benefits and considerations associated with these investments is vital for long-term financial success.

Navigating The Emotional Aspects Of Wealth

Navigating the emotional terrain of wealth requires a deep understanding of behavioral finance. Psychology plays a crucial role in shaping financial decisions. Emotional intelligence comes into play when making important choices about money. Practicing mindfulness and gratitude can aid in effective wealth management.

By being aware of our emotions and thoughts, we can approach financial matters with clarity and sound judgment. Being mindful of our spending, investing, and saving habits can help us align our financial goals with our values. Gratitude allows us to appreciate and cherish the wealth we have, fostering a healthy perspective on money.

By mastering the emotional aspects of wealth, we can ensure a balanced and fulfilling financial journey.

Conclusion

We have explored the many dimensions of finance and its impact on our lives. From understanding personal finance to navigating the complex world of investments, finance plays a crucial role in shaping our future. We have also delved into the importance of financial literacy and how it empowers individuals to make informed decisions.

Beyond finance, we have seen how our choices in areas such as healthcare and sustainable living can have financial implications. It is clear that finance goes beyond just numbers and transactions; it is about making choices that align with our values and long-term goals.

By staying informed, continuously learning, and seeking professional advice when needed, we can navigate the ever-changing landscape of finance with confidence and achieve our financial aspirations. Remember, financial well-being is not just about accumulating wealth, but about using our resources wisely to create a fulfilling and prosperous life.

So let’s embrace the power of finance and make it work for us in achieving our dreams.