Continental finance offers a range of financial solutions to help you meet your goals and manage your expenses. With a variety of credit card options designed to fit different needs, continental finance can provide the financial resources you need to achieve financial success.

We offer flexible payment options, convenient online account management, and excellent customer service to ensure that your experience with continental finance is positive and hassle-free. Whether you’re looking to build your credit, consolidate debt, or make everyday purchases, continental finance has a credit card solution for you.

Choose continental finance for all your financial needs and start your journey to financial freedom today.

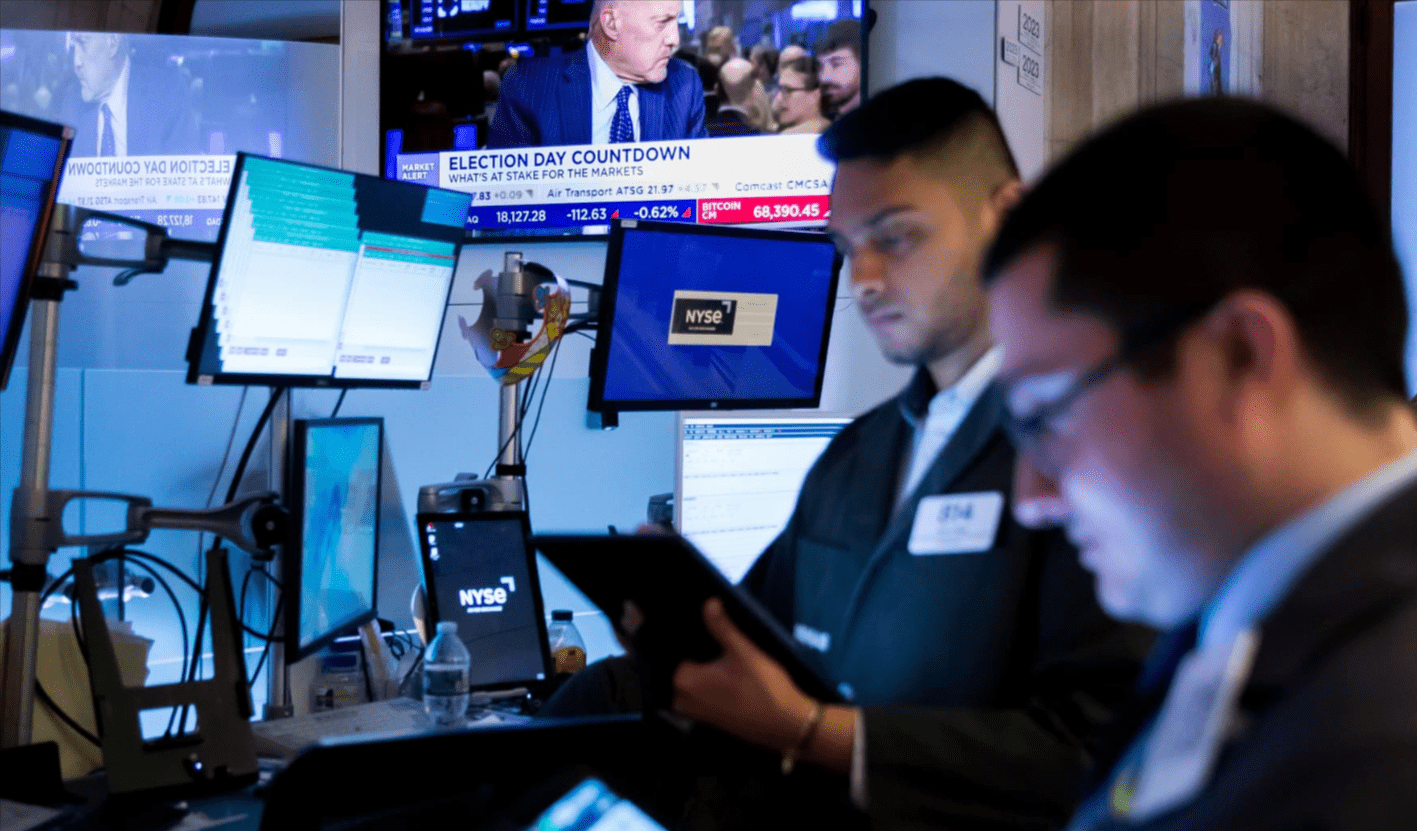

Credit: www.cutimes.com

Understanding The Importance Of Continental Finance

Understanding the importance of continental finance is crucial for achieving financial success. Continental finance plays a significant role in wealth management, offering unique advantages that can help you reach your financial goals. With its expertise and comprehensive range of services, continental finance ensures that your wealth is effectively managed, allowing you to make informed investment decisions.

By leveraging continental finance’s resources and knowledge, you can optimize your financial strategies and maximize returns. Whether you are an individual or a business owner, continental finance offers tailored solutions to meet your specific needs. Its commitment to providing personalized service sets continental finance apart from other financial institutions.

With continental finance by your side, you can navigate the complex world of finance with confidence and achieve long-term financial success.

Building A Strong Financial Foundation

Building a strong financial foundation is crucial for overall financial well-being. It starts with establishing clear financial goals and determining what you want to achieve. Next, creating a budget and sticking to it allows you to effectively manage your income and expenses.

It helps you become more mindful of your spending habits and make necessary adjustments. Additionally, developing an emergency fund is essential to handle unexpected financial situations. By setting aside money for emergencies, you can avoid going into debt and have peace of mind.

Remember, establishing a solid financial base requires discipline and commitment. Stay focused on your goals and make informed decisions that align with your long-term financial success.

Maximizing Returns With Smart Investment Decisions

Maximizing returns requires smart investment decisions, such as diversifying your portfolio. By not putting all your eggs in one basket, you spread the risk and increase the potential for higher rewards. Identifying high-quality investment opportunities is crucial in this process.

Conduct thorough research on potential investments, considering factors like financial stability, market trends, and projected growth. It’s essential to strike a balance between risk and reward, as higher returns often come with increased volatility. Assess your risk tolerance and make sure your investment choices align with your financial goals.

Continental finance offers a range of investment options to meet the diverse needs of investors. By making informed decisions and staying focused on maximizing returns, you can achieve financial success in both the short and long term.

Utilizing Continental Finance Tools For Wealth Management

Continental finance offers a range of tools for efficient wealth management. Its digital platforms provide excellent opportunities for leveraging your financial assets. You can explore their asset management services to further enhance your investment strategy. Additionally, their financial planning resources are specifically designed to help you make the most of your financial decisions.

With continental finance, you can optimize your wealth management goals, ensuring your financial success for the long term. Whether it’s utilizing their digital platforms or taking advantage of their financial planning resources, continental finance offers comprehensive solutions to meet your wealth management needs.

So, start leveraging continental finance today for a brighter financial future.

Navigating Market Volatility With Confidence

Market volatility can be challenging. Understanding its impact is crucial for developing a long-term investment strategy. Seek professional guidance from continental finance to navigate fluctuations confidently. Their expertise can provide valuable insights and help you make informed decisions. By staying updated with market trends and analysis, you can optimize your investments and maximize returns.

Trust continental finance to guide you through the ever-changing financial landscape. With their support, you can weather the storm of market volatility and achieve your financial goals. Embrace the opportunity to enhance your investment knowledge and gain the confidence needed to excel in the market.

Continental finance is here to empower you on your investment journey.

Ensuring Financial Security For The Future

Financial security for the future is a top priority. Continental finance helps in planning for retirement, protecting assets through estate planning, and managing tax obligations. With continental finance’s expertise, individuals can ensure a stable financial future. Planning for retirement is essential, as it allows individuals to secure their financial well-being in their golden years.

Estate planning helps protect assets by ensuring that they are distributed according to one’s wishes. Additionally, continental finance assists in managing tax obligations, providing expert advice to minimize tax liabilities. By utilizing continental finance’s services, individuals can navigate the complexities of finance and safeguard their financial security for the long term.

Adapting To Changing Economic Trends

Adapting to changing economic trends is crucial for success in today’s financial landscape. Embracing innovations in financial technology is key in navigating through these shifts. Staying informed on global economic developments enables businesses to make informed decisions and seize opportunities.

Capitalizing on opportunities in emerging markets can lead to significant growth and expansion. By staying ahead of the curve and embracing new technologies, businesses can gain a competitive edge. The ability to quickly adapt and respond to changing economic trends is essential for long-term success in the financial industry.

Being proactive in implementing new technologies and embracing emerging markets can help businesses thrive in an ever-evolving global economy. Stay informed, be innovative, and capitalize on the opportunities that arise.

Conclusion

Continental finance offers a comprehensive range of financial solutions to meet the diverse needs of individuals and businesses. From credit cards to personal loans, they strive to provide accessible options for those in need of financial assistance. With a focus on customer satisfaction and competitive interest rates, continental finance aims to make the borrowing process as seamless as possible.

Their online platform offers a user-friendly interface for easy application and management of accounts. Whether you are looking to rebuild your credit or consolidate debt, continental finance has the tools and resources to help you on your financial journey. So why wait?

Take advantage of continental finance’s offerings today and take control of your financial future. Trust in their expertise and experience to guide you towards a brighter tomorrow.